This week we are continuing our series "Big Questions in Real Estate" featuring big, important questions about real estate provided by you! This question has been circulating around the news and is one of the biggest questions that can be debunked with education. Rather than telling you the differences, we felt it was important to show you the data. This month's big question is:

"Are we headed towards a housing market crash?"

Let’s find out.

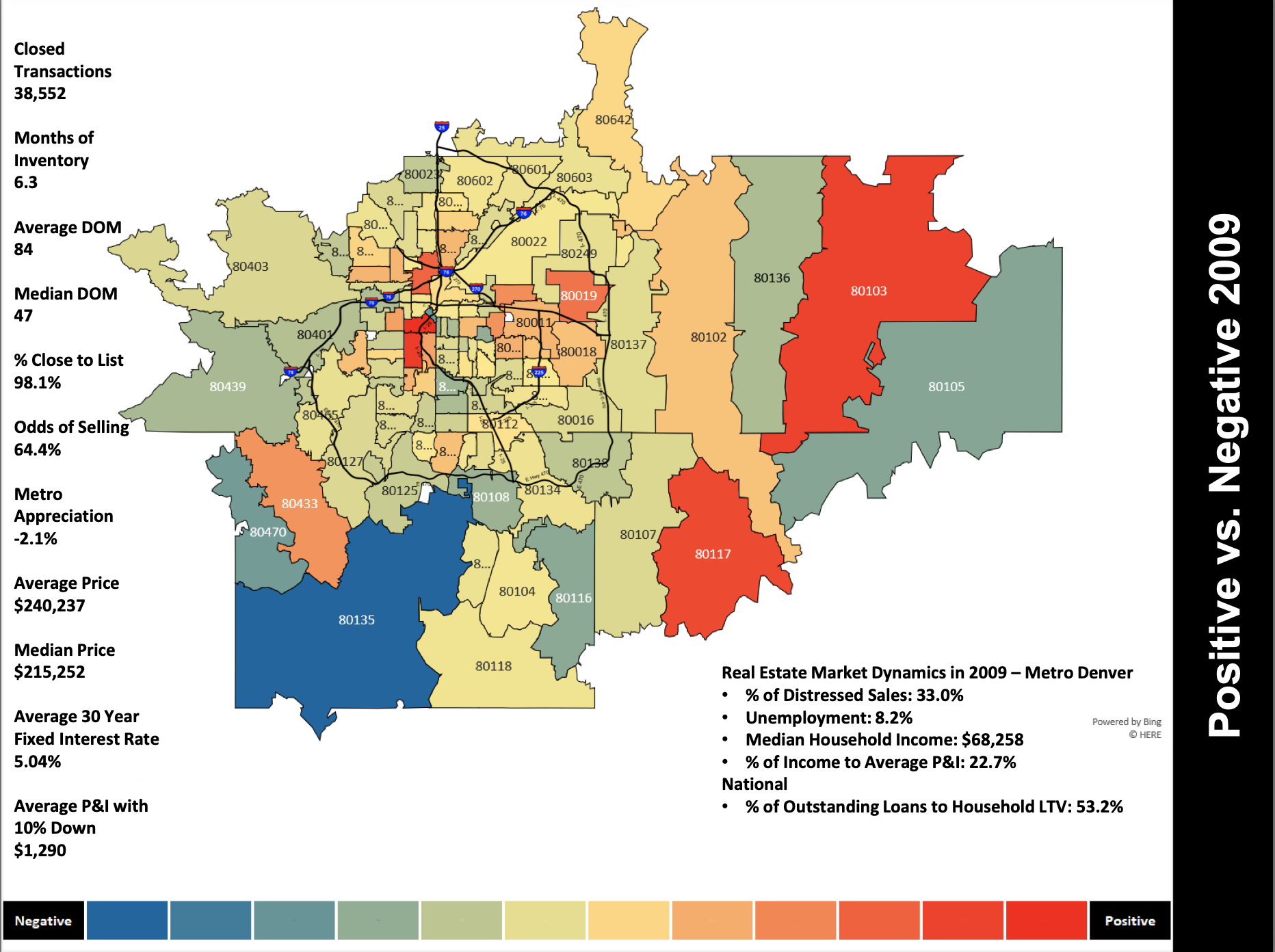

Real Estate Market Dynamics for 2009

The housing crisis of 2008 left many homeowners struggling with payments, financial losses, and a loss of appreciation on their biggest investment. It's extremely valid to be concerned about this, but we want to assure you that the factors involved in the crisis are not currently happening. To visualize the effects of 2008, we pulled the data for 2009 when the crisis was in full effect in Denver Metro. On top of predatory lending practices, here are some other factors to consider:

Unemployment was at 8.2% in Denver and 33% of homes were distressed.

Those that needed to sell were up against a balanced market with 6.3 months' supply of inventory or about 35,000 homes on the market.

Homes sat on the market for nearly 3 months before selling at 98.1% or just under list price.

Even though we were at the height of the crisis, homeowners still had a 64.4% chance of selling.

Appreciation in Denver only dropped 2.1% during this time.

Bottom Line

Even in the worst of the market crash, Denver Metro's homeowners did not see a major drop in their appreciation, close to list price, or odds of selling.

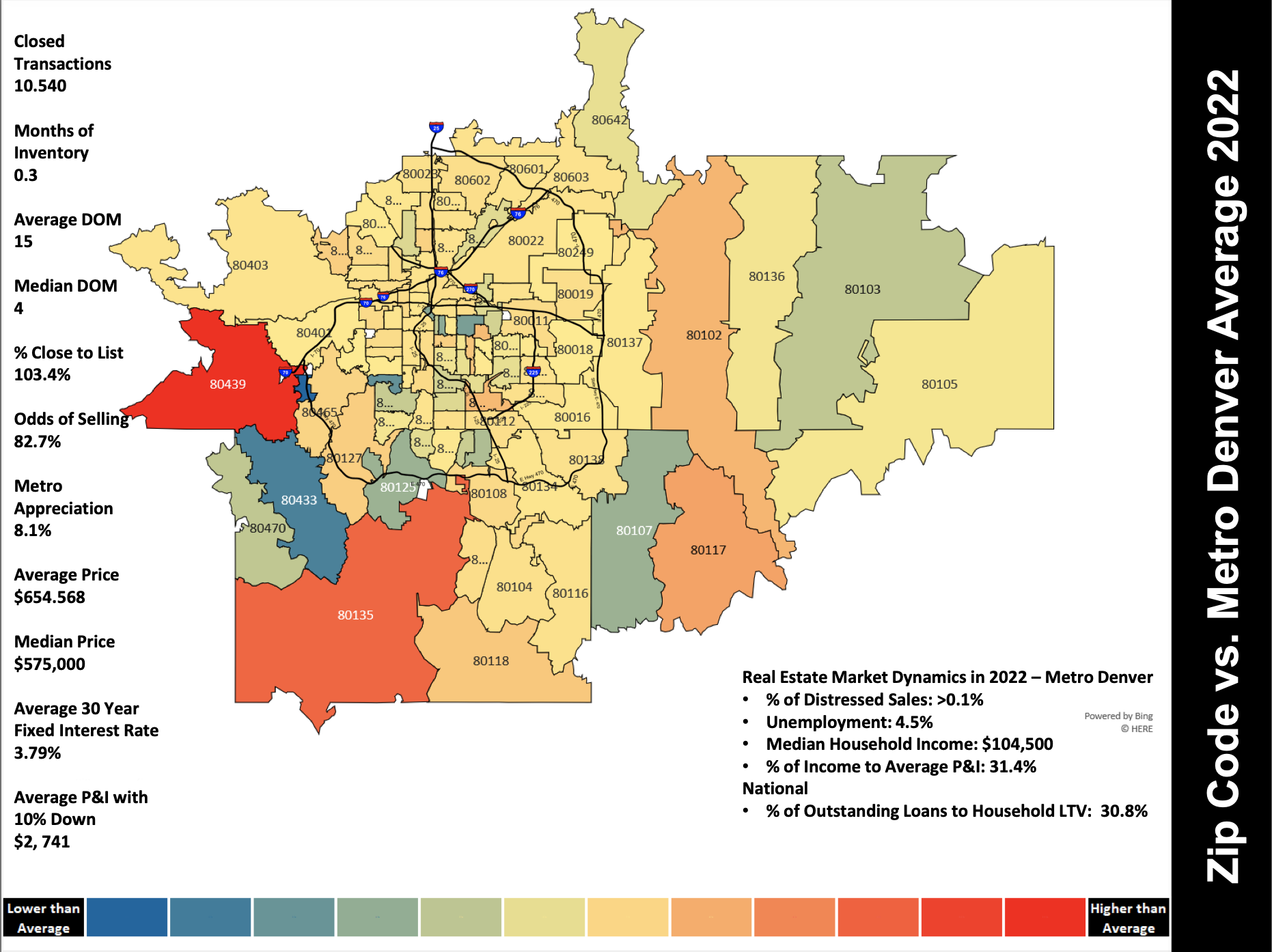

Real Estate Market Dynamics for 2022

We aren't fully through the year so this data will update as we go, but when we compare the factors in 2009 we can be very confident that a housing crisis is not about to happen in Denver Metro.

Unemployment is at 4.5% and less than 0.1% of homes are distressed.

Those who need to sell have an 82.7% odds of selling and homes will stay on the market only 15 days before going under contract.

Homes are selling at 103.4% of the list price so if a homeowner is in financial distress, they can sell their home quickly and over the asking price.

In 2009, the median household income was $68,258 but now our median household income is $104,500.

Appreciation in Denver is at 8.1% and more in many areas.

Bottom Line:

The housing crisis happened, in part, due to the financial distress of homeowners who couldn't sell their homes fast enough to pull themselves out. Right now, if a homeowner needs to sell, they are in one of the best positions in history to do so.

Fun Fact

If you bought your home in 2008 for $245,732, the value would have only dropped to $240,607 in 2009. If you kept your home and wanted to sell it today, it would be worth $654.568. You made a great investment!